Introduction

Sanctions have become one of the most powerful geopolitical tools in the modern world. Once used sparingly and aimed at rogue states, they now reach deep into the lives of individuals and private companies. For global investors and high-net-worth individuals (“HNWIs”), understanding sanctions is essential.

Whether you are moving money across borders, holding assets through offshore structures, or operating a global business, the risk of sanctions exposure is real. But what makes sanctions so complex and so potent is that they often extend far beyond the jurisdiction that imposed them. A measure taken in Washington can freeze a bank account in Dubai. A designation by the UK government can unravel corporate structures in Cyprus. And a reputational red flag triggered in Brussels can follow someone around the world for life.

In this insight, we explore how sanctions regimes work in the UK, US, and EU, who enforces them, how they are coordinated, and most importantly, how they affect global investors in practice.

What Are Sanctions, and Why Do They Matter?

Sanctions are legal restrictions imposed by governments or international bodies to pressure countries, individuals, or organisations into changing certain behaviours. They are often used to respond to serious international events such as armed conflicts, nuclear weapons programmes, human rights abuses, or corruption.

The idea is simple: by cutting someone off from the global financial system, trade networks, or travel rights, you make it harder and costlier for them to carry on as usual.

Sanctions can take many forms:

- Freezing someone’s assets

- Banning them from entering a country

- Blocking exports of key goods like technology or oil

- Preventing banks from processing certain payments

Although these measures are created by national governments or international organisations, their effect often ripples across the globe. For example, a person sanctioned in the US may find their UK bank account closed. A company sanctioned in the EU may lose access to partners in Asia or the Middle East, not because the law requires it but because the risk is too high for anyone to keep dealing with them.

This is what makes sanctions such a powerful force and such a critical issue for those with cross-border exposure.

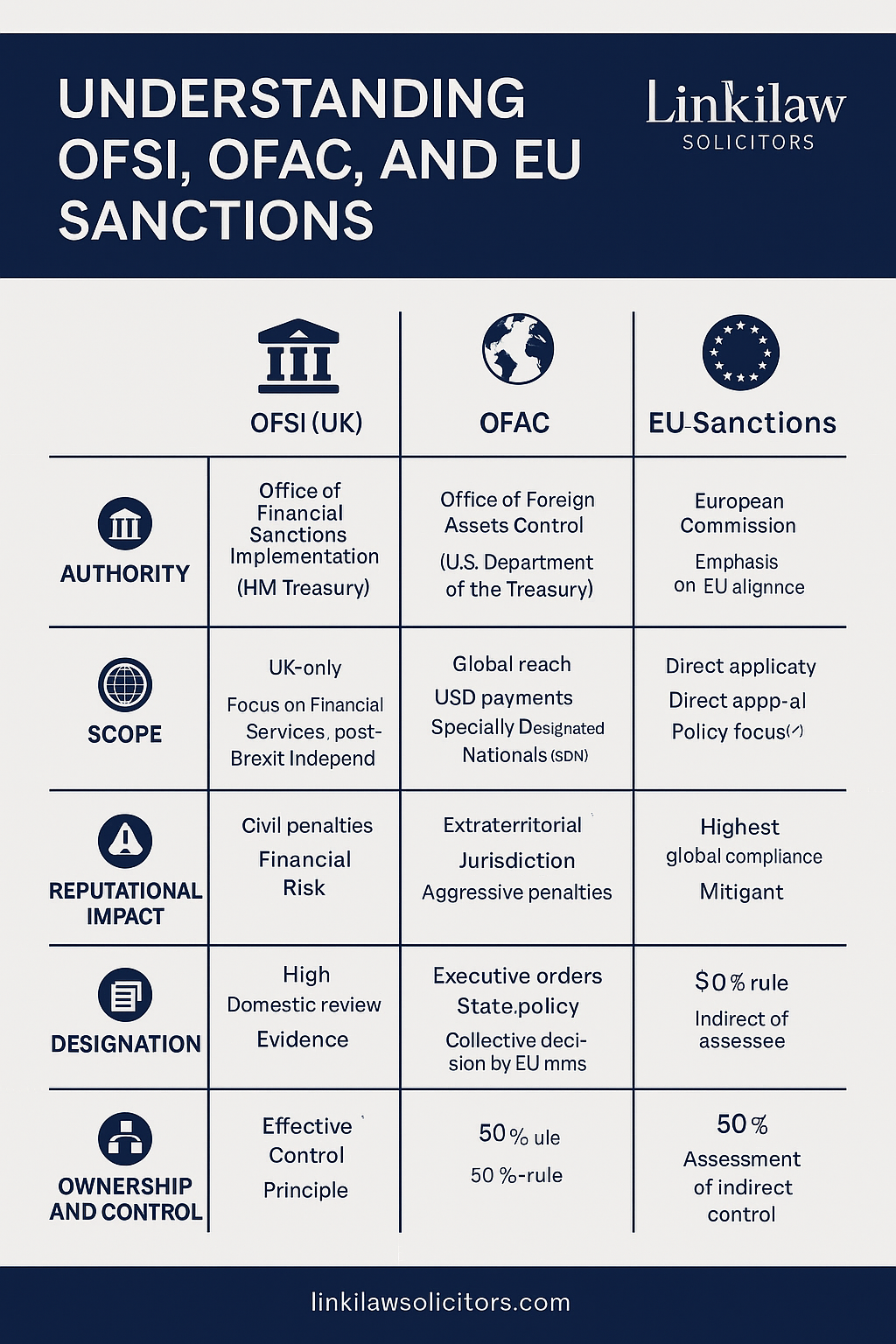

The Enforcers: OFSI, OFAC, and the EU Commission

Sanctions are only as effective as the authorities who create and enforce them. The three main players in the Western world are:

1. The UK’s OFSI (Office of Financial Sanctions Implementation)

The UK’s sanctions authority is OFSI, part of HM Treasury. After Brexit, the UK created its own fully independent sanctions regime under the Sanctions and Anti-Money Laundering Act 2018 (“SAMLA”). This means the UK is no longer bound by EU sanctions decisions and can impose its own measures.

OFSI maintains a consolidated list of designated individuals and entities. If you are on this list, UK financial institutions must freeze your assets, and no one in the UK is allowed to provide you with funds or economic resources. OFSI also investigates and enforces breaches, including by issuing civil fines, sometimes even if the breach was unintentional.

What makes OFSI unique is that it relies heavily on the financial and legal sector (e.g. banks, investment firms, and lawyers) to monitor and report sanctions breaches. This makes financial institutions and professionals cautious. As a result, even the appearance of a sanctions risk can cause someone to be de-banked, scrutinised, or frozen out of the system.

2. The US’s OFAC (Office of Foreign Assets Control)

The US sanctions regime is enforced by OFAC, a division of the US Treasury Department. It is widely considered the most aggressive, far-reaching, and feared of all sanctions authorities.

OFAC has the power to blacklist individuals, companies, banks, sectors, and even whole countries. Once someone is placed on the “Specially Designated Nationals” (“SDN”) list, they are effectively cut off from the global financial system. US persons and companies are forbidden from dealing with them, and any assets they hold in US territory are frozen.

However, OFAC’s power goes much further than US borders. As the US dollar is the world’s dominant currency, nearly all cross-border trade passes through US banks at some point, even if the parties are outside the US. This gives OFAC legal jurisdiction over many transactions that take place far beyond its territory.

For example, a UK-based company making a payment in US dollars to a Russian supplier via a European bank could be considered in breach of US sanctions even if no Americans are involved.

OFAC is also known for its enormous enforcement penalties. Some banks have paid billions in fines for sanctions violations, and even small breaches can trigger years of litigation, reputational damage, and financial exclusion.

3. The EU’s Sanctions Regime

The European Union also has a powerful sanctions framework. Unlike the UK or US, the EU’s sanctions are decided collectively by all 27 member states and then implemented directly through EU law.

The European Commission plays a key role in creating the legal regulations that make sanctions binding. Enforcement, however, is carried out by national governments, which can lead to differences in speed, consistency, and interpretation across the bloc.

The EU tends to favour sanctions that are clearly tied to international law and diplomatic strategy. It often imposes sectoral restrictions like banning exports of dual-use goods (technology with military applications) or prohibiting financial services to specific regions.

While EU enforcement may not always be as high-profile as the US, its legal framework is robust and deeply integrated into the economies of member states.

How These Regimes Work Together: The Power of Coordination

Although OFSI, OFAC, and the EU all operate independently, they often move in parallel especially when sanctions are intended to achieve a geopolitical or behavioural objective.

For instance, at the start of the Russia-Ukraine conflict in 2022, all three authorities responded within days. They coordinated sanctions against Russian oligarchs, politicians, state-owned enterprises, and banks. In many cases, individuals were sanctioned by the UK, US, and EU on the same day, with similar restrictions.

This kind of coordinated action increases pressure by removing safe havens. If a sanctioned individual cannot access assets in the US, UK, or EU or transact in dollars, euros, or pounds their global financial position becomes unsustainable.

There is also constant behind-the-scenes collaboration. Intelligence-sharing, diplomatic coordination, and joint task forces make sure sanctions are not easily avoided or undermined. This is especially true when sanctions are aimed at state actors like Iran, North Korea, or Syria.

Sanctions and Their Global Reach: Territorial Laws, Worldwide Impact

Although sanctions are laws made by individual governments or blocs, their impact is often global. This happens in several ways:

1. Dollar Dominance

Because the US dollar is the backbone of global finance, many international payments, even between two non-US parties, are routed through US correspondent banks. As a result, a transaction that never touches US soil can still fall under OFAC jurisdiction.

For example, a Chinese buyer paying a Turkish seller in USD may have their transaction blocked if the Turkish seller is on the US sanctions list. This gives OFAC enormous leverage over global trade.

2. Risk Contagion in Financial Systems

Financial institutions across the world, not just in sanctioned jurisdictions, rely on global compliance databases like World-Check, LexisNexis, and Dow Jones. These tools automatically flag sanctioned individuals and entities, often in real time.

This means that even if a person is only sanctioned by one regime (say, OFAC), banks in other regions (like the UK or EU) may still treat them as high-risk. Accounts may be frozen, applications rejected, or existing relationships terminated, not necessarily due to a legal obligation but because of reputational or compliance risk.

In effect, sanctions cast a much wider net than their legal wording implies.

3. Proxy Ownership and Indirect Control

Modern sanctions regimes are sophisticated enough to target not just named individuals but also their networks.

In the US, the “50 Percent Rule” means that any company that is 50% or more owned by a sanctioned individual is also considered sanctioned even if the company itself is not listed. The UK and EU apply similar principles, looking at indirect control or influence.

This makes it increasingly difficult for sanctioned persons to use proxies, shell companies, or nominees to continue doing business. And with the global push for beneficial ownership transparency, hiding behind corporate structures is no longer a reliable shield.

The Hidden Damage: Reputational and Commercial Fallout

For global investors, the consequences of sanctions go far beyond legal prohibitions. One of the most devastating impacts is reputational damage.

Once sanctioned, an individual or company is listed in every major compliance database in the world. These lists are checked daily by banks, insurers, regulators, and even clients and counterparties. Being on such a list, or even associated with someone who is, can close doors instantly.

Even if the sanctions are later lifted, the damage is done. Banks may still refuse to re-establish relationships. Credit lines dry up. Business partners walk away. In some cases, people who were never sanctioned directly but merely suspected of association face years of exclusion based on perceived risk.

This is why proactive risk management, transparency, and legal strategy are so important in today’s sanctions environment.

Conclusion: What Global Investors Should Do Now

Sanctions are evolving fast. They are no longer slow-moving diplomatic tools. They are now used to target individuals with speed, precision, and global effect.

For international investors, family offices, and HNWIs, this creates new layers of complexity. It’s no longer enough to stay on the right side of the law. You must also stay on the right side of global perception, banking compliance, and reputational due diligence.

At Linkilaw, we help clients navigate this landscape. From screening exposure and to responding to designations or unwinding risk, our role is to help you stay legally safe, reputationally clean, and commercially agile.